Real-estate investors often face the task of reinvesting profits in one property while avoiding hefty taxes. The good news is that the IRS has created a tax-free investment vehicle for this very purpose, referred to as the 1031 exchange. By utilizing this strategy, investors can exchange their property for another without paying capital gains tax.

But imagine if you're buying more hands-off way of property investment? That's where the 1031 exchange advisor. comes in. In this blog post, we'll explore the key features of this original investment vehicle and why it's increasingly popular among investors.

DST 1031 Exchanges are Passive Investments

One of the main features of DST 1031 exchanges is they are passive investments. Unlike traditional property investments that want hands-on management, DST investments allow investors to relax and let a specialist management firm handle the day-to-day operations, such as for example leasing, collecting rent, and maintaining the property.

This hands-off approach makes it a nice-looking investment selection for busy investors who don't have the full time or inclination to handle properties themselves. With DST investments, you are able to still take advantage of the income streams that are included with owning a property while avoiding the headaches that typically include property management.

Diversify Your Portfolio Minus the Hassle

Investors who would like to diversify their portfolio oftentimes believe it is challenging to do this without the hassle of acquiring multiple properties. By utilizing a DST 1031 exchange, investors can diversify their portfolio while avoiding the headache that accompany buying and managing multiple properties.

A DST investment enables you to own a part of a more substantial property along with other investors, spreading your investment across multiple properties while only owning a fraction of each property. This method makes for the potential of greater diversification without having to be in charge of managing individual properties.

Reap the Tax Advantages of a 1031 Exchange

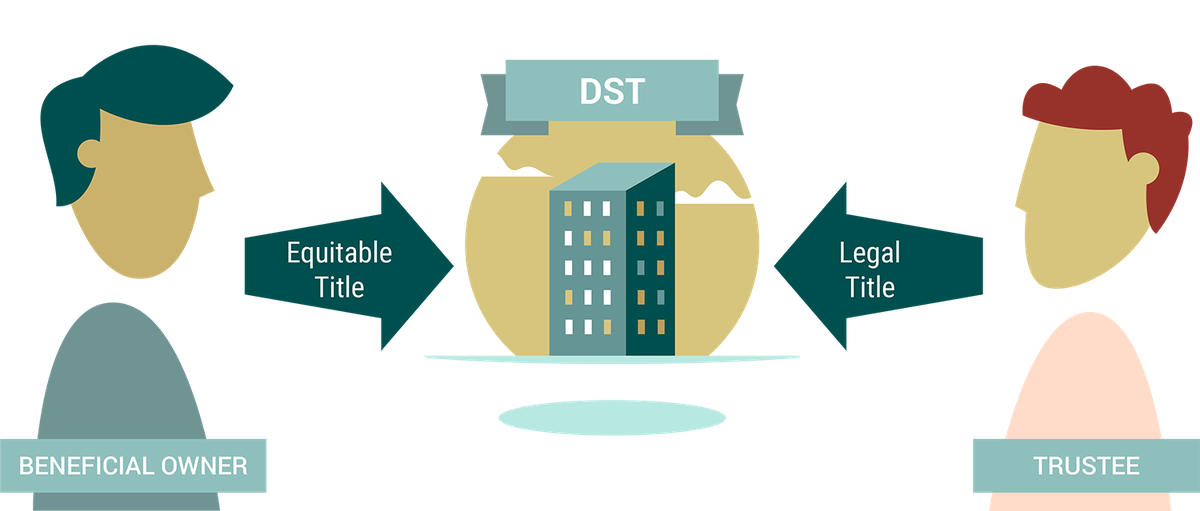

A DST 1031 exchange provides investors with the exact same tax benefits as a conventional 1031 exchange. By exchanging an old property for a new one, you can defer paying capital gains tax and depreciation recapture tax. What this means is you can reinvest the profit you earn from the sale of one's old property right into a new property without worrying about the hefty tax burden that could normally include it.

In a DST 1031 exchange, you are able to invest your proceeds from a purchase of a property and own a fractional curiosity about a bigger property, which allows you the ability to potentially earn higher income than had you reinvested within a investment property.

Low Minimum Investment

Another significant advantage of a DST 1031 exchange is so it requires the absolute minimum investment of just $100,000. This helps it be an accessible option for small investors seeking to reap the advantages of a 1031 exchange without the necessity for an individual property valuation. The lower investment amount also makes it simpler to diversify your portfolio without breaking the bank.

DST 1031 Exchanges Allow For Greater Flexibility

DST 1031 exchanges allow for greater investment flexibility than an overall property acquisition. Investors aren't bound to specific properties and tend to be more able to offer their curiosity about the investment, providing greater liquidity than traditional property ownership.

Many investors also appreciate that right after selling home, they are able to quickly reinvest their profits in to a DST investment with no hassle of property valuations or management. This results in an even more streamlined and efficient investment procedure that may result in greater profits for investors.

Conclusion:

Picking a DST 1031 exchange as your investment vehicle provides many advantages. Not merely do you benefit from the tax great things about a normal 1031 exchange, but you can even benefit from passive investments, diversification of one's portfolio, low minimum investment, greater investment flexibility, and a more streamlined investment process. By going for a closer consider the key benefits of a DST 1031 exchange, investors can make informed choices that lead to greater success. So, if you're buying a hands-off, tax-efficient solution to reinvest your real estate profits, a DST 1031 exchange might be just the one thing you'll need to develop and diversify your portfolio.